01 LAB - tech and innovation agency

Leveraging pioneering tech to deliver impactful digital experiences for ambitious brands.

02 Unparalleled.

We create unparalleled industry solutions in technology, research and creativity. Either by partnering with progressive brands or by developing the IP ourselves.

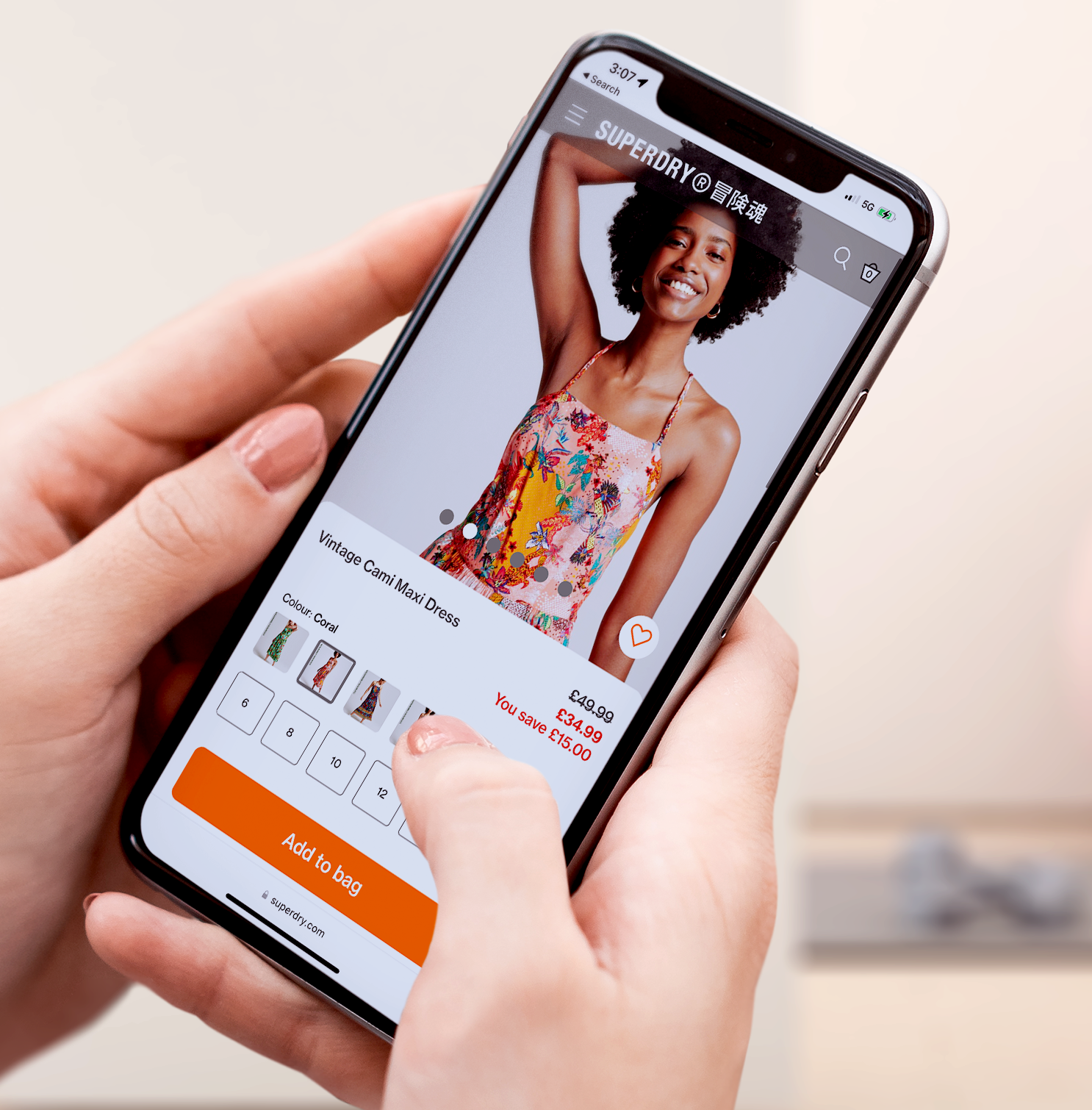

Challenged to transform Superdry’s mobile shopping experience, our specialist agencies used both quantitive and qualitative research and data to inform UX/UI design and development to achieve a significant increase in conversion.

UX DESIGN

ECOMMERCE

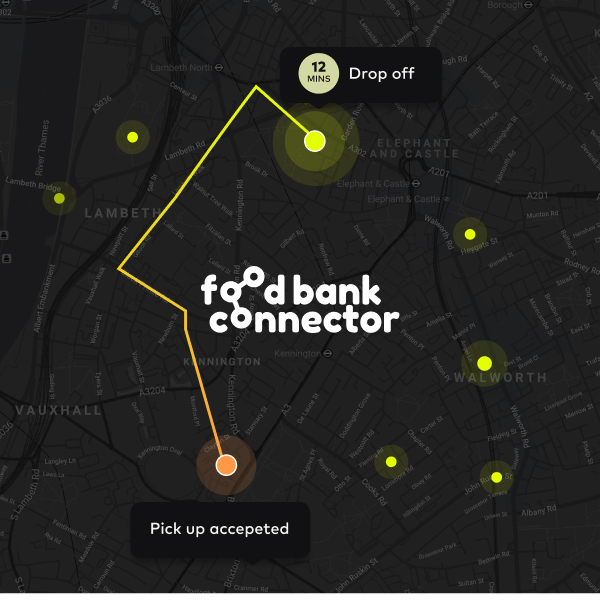

When creative thinking, digital innovation and a desire to make meaningful societal change combine, we start to move the game forward. In a moment of profound global distress, our technology has the power to tangibly and meaningfully help those most in need.

CREATIVITY FOR GOOD

TECH & INNOVATION

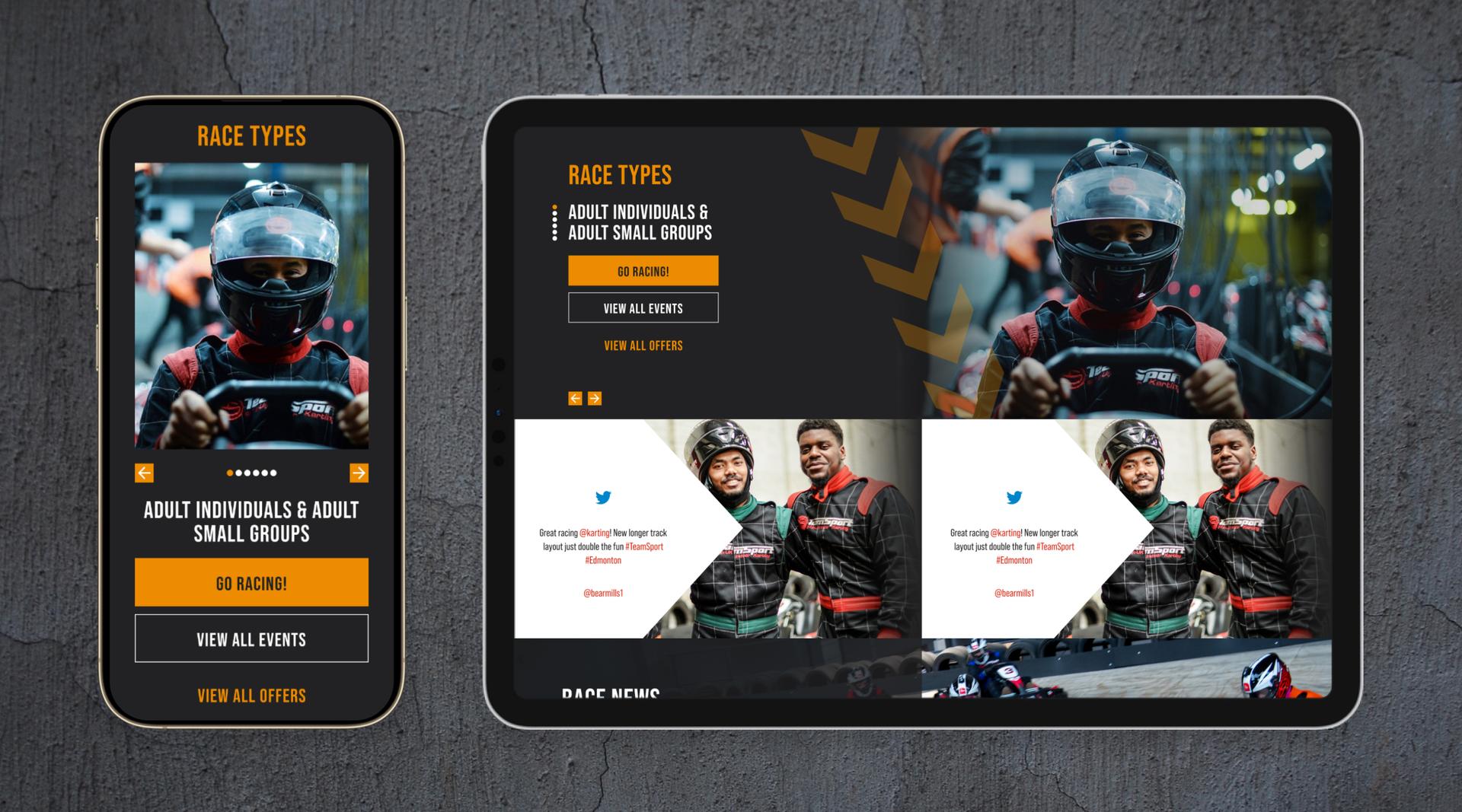

Teamsport has a complex product offering, their legacy booking system was limiting their ability to scale. We prototyped, designed and built a new booking journey using composable architectures to improve the user experience.

USER EXPERIENCE

UI

COMPOSABLE ARCHITECTURE

LAB’s Research and Insight experts partnered with Innovate UK to develop our unique IP, applying offline psychological research to digital journeys, making the possibility of protecting vulnerable online users a reality.

RESEARCH & INNOVATION

HUMAN BEHAVIOUR

03 Talented alone. Extraordinary together.

Fueled by a desire for innovation and possibility, we unite specialists from the academic world with creative thinkers from digital, design and storytelling. Our focus: together we deliver new approaches, lasting emotional impact and tangible results.

04 TRUSTED BY BRANDS WITH PURPOSE

05 News and Insights

If we begin to change the way we look at things, then the way that things look will change. We combine unique disciplines and mindsets for experimental thinking that creates unimagined breakthroughs and new perspectives on age-old problems, commercial or societal.

Internet Explorer

Please use Microsoft Edge, as Internet Explorer is no longer supported by Microsoft.